Investment risk assessment

Customer , owner

year of foundation: 1995 (low risk), year of foundation affects the level

completed projects / total: 0/1 (high risk) number of objects handed over affects the level

accounts payable litigation: none (risk low)

Customer # 2, Developer, General Contractor

Foundation year: 1995 (low risk)

completed projects / total: 50/90 (medium risk)

lawsuits affecting payables: more mil UAH. (above average risk)

The financial partner is a bank ......

name of the property

Residential complex "............."

Class economy, ..

changes in change: there are changes in change from ... to ... (risk is below average).

construction stage:

Queue number 1 - commissioned ..... (low risk);

The queue number 2 - built of floors (high risk), planned input in ......

financing scheme: Property Purchase and Sale Agreement (above average risk)

permits:

1. Decision .... from ..... No. ... on providing ...... for construction, operation and maintenance of residential buildings with built-in and attached premises;

2. Permission to perform construction works of the series ......

3. Certificate of Conformity Series І ....

4. permission to connect to urban communications

Game: Perform tasks and rest cool.3 people play!

Play game

Total risk

Game: Perform tasks and rest cool.3 people play!

Play game to analyze the main methods of risk assessment of real estate investments in foreign and Russian practice and to identify their features and disadvantages for the purpose of substantiating investment and financial decisions when investing in real estate;

propose an algorithm for assessing the risks of investing in commercial real estate;

to carry out an investment risk assessment using the proposed algorithm using the example of an industrial facility redevelopment project.

In recent years, the theory and practice of managing investment projects have been enriched with various methodologies for assessing the risks of investment projects, providing investors with the necessary information to make close to optimal decisions. The choice of method depends on the specific project and the tasks that the investor sets itself.

At the same time, the general algorithm for project evaluation under uncertainty and risk management is typical and includes the following points:

1. Identifying the causes and sources of risk, identifying the stages of the project at which the risk occurs.

2. Identification of all possible risks inherent in the investment project under consideration.

3. Assessment and analysis of the level of individual risks and the risk of the project as a whole, determining its economic feasibility.

4. Determination of acceptable risk level.

5. Development of measures to optimize the project and minimize project risks.

In accordance with these stages, the methodology for assessing the risk of an investment project can be divided into two mutually complementary areas: qualitative methods (paragraphs 1, 2, 5) and quantitative methods (paragraphs 3.4).

Qualitative methods for assessing project risks

The main objectives of the methodology for qualitative risk assessment of a project are to identify, using the above classifications, the possible types of project risk and their sources, to identify and describe the factors and causes affecting their level. In addition, it is necessary to give a valuation of all possible consequences of the implementation of these risks and identify specific measures to minimize the risk under consideration and / or compensate for its consequences.

A qualitative analysis of project risks is outwardly very simple, descriptive, but in essence its results serve as important background information for carrying out quantitative analysis.

The methodological recommendations of ISO 31000: 2009 (Risk management-Principles and guidelines) [10] recommend using the following methods when assessing the risks of investment projects: SWOT analysis, analysis using a decision tree, the Delphi method. However, in practice, as noted in most sources, a greater degree of use was applied analysis of the appropriateness of costs, expert method, the method of analogies.

Analysis of the relevance of costs.

This method is to identify areas of risk. It is assumed that the possible sources of risks associated with cost overruns are:

• The increase in the cost of the project compared to the original is due to inflation and / or changes in tax laws;

• underestimation of the cost of the project as a whole or its individual stages;

• change in the scope of investment due to unforeseen circumstances, etc.

Game: Perform tasks and rest cool.3 people play!

Play gameThe method of analogies.

The method of analogies is to analyze the data for similar projects in order to calculate the probability of loss. Speaking of real estate, this technique is often used in assessing the risks of projects in construction.

In the process of analyzing the risk of a new project, data are used on the effects of adverse factors on other analogous projects. When choosing a similar project, data from research work of design institutions, data on analogues, as well as surveys of managers of these projects are used. Then, the collected materials are processed to identify dependencies in already implemented projects to account for and assess the potential risk in a new investment project. When using the methodology, it is necessary to compare the initial on the projects and take into account the differences, since the projects cannot be absolutely similar.

Due to the specificity of each real estate project, it is impossible to prepare an exhaustive set of plausible project development scenarios that would truly reflect the picture of what is happening, since most of the failures have their own specific reasons, which may not be present in the project under consideration, really existing in your project.

Game: Perform tasks and rest cool.3 people play!

Play gameThis technique consists in using the experience of experts in the process of project analysis and taking into account the influence of various qualitative factors. This technique is mainly used at the initial stages of work with the project in case the initial data are not enough to conduct a quantitative analysis of the project's effectiveness.

The algorithm of the method of expert risk analysis consists in applying the following points:

• development of a list of evaluation criteria in the form of expert sheets containing questions;

• assignment of weights for each criterion, unknown to the expert commission;

• drafting response options for each criterion, the weight of which is also not reported to the experts;

• analysis by experts of the project being assessed and assignment of marks for each criterion;

• processing expert sheets of statistical packages and analysis of the results of the examination.

A variation of the expert risk assessment method is the Delphi method, a feature of which is the strict procedure for organizing an assessment, in which experts are unable to jointly discuss the answers to the questions posed. Thus, objectivity is maximized within this method.

The main disadvantage of the methodology is the difficulty in selecting and attracting independent experts and the subjectivity of assessments. The main advantages of the expert method are the absence of the need for accurate and complete source information, as well as the necessary software. Expert risk analysis can be carried out before calculating the project performance parameters, and it is relatively easy to use.

Quantitative analysis of project risks

The task of quantitative analysis methods is to measure the impact of changes in risk factors on the project efficiency. Quantitative risk assessment, that is, the numerical determination of the size of individual risks and the risk of the project as a whole, is more complicated than qualitative. First, all risks are measured in units peculiar to each of them, then in monetary units and, finally, the risk of the project as a whole is evaluated. In some cases, the probabilities of the occurrence of risk events and their consequences are determined, a quantitative assessment of the level of risk is carried out, the acceptable level of risk in this situation is determined.

In the economic literature on the problem of risk, there are many different quantitative methods for assessing the risk of investment projects. All studies can be divided into:

statistical techniques;

analytical assessment methods. The task of statistical methods is to determine the probability of the occurrence of adverse events on the basis of a statistical study of the available data on the project. That is, in this case, the risks for the project are estimated using the indicators of the standard deviation, variance, coefficient of variation, and the results of their influence on the basis of the average expected values of the studied indicators.

Depending on the depth of the analysis, it is possible to study and evaluate individual adverse events, but the more correct is the idea of an adverse event as an integral (multiparameter) value determined on the basis of private risks [2].

Game: Perform tasks and rest cool.3 people play!

Play gameThe disadvantage of this method is the need for a large sample for an objective and reliable analysis.

Analytical methods consist in the construction of deterministic and probabilistic analytical risk models. They include:

Monte-Carlo simulation method.

method of building a "decision tree";

sensitivity analysis;

method of adjustment of individual project parameters;

Monte Carlo method

This technique allows you to assess the risks by creating random scenarios for the development of the project. The result of the risk analysis is expressed not by one indicator of the efficiency value (NPV, IRR), but in the form of a probability distribution of all possible values of this indicator, i.e. an investor with will have a complete set of data describing the risk of the project on the basis of which he will be able to make an informed financing decision [8].

Game: Perform tasks and rest cool.3 people play!

Play gameMethod "decision tree"

Method "decision tree" used for risk analysis of projects with a finite and limited number of development options. It is useful in situations where there are several consecutive decisions, with subsequent decisions based on the results of previous ones. A “decision tree” is represented as a graph, vertices are private states in which the need for selection arises, and branches of a tree are various events that can occur in each particular state. Each branch is assigned a different numerical characteristics (amount of payment, financial flow and the likelihood of its implementation).

This method is usually used to analyze the risks of those projects that have a finite (relatively small) number of development options. Most often it is used in projects during the implementation of which the financing of funds occurs in stages for a long time, which is an atypical situation in relation to investing in real estate.

Sensitivity analysis

Sensitivity (vulnerability) analysis of project performance criteria (sensivity analysis) is the most frequently used quantitative method of risk assessment. It allows you to analyze the effect of a given factor on the value of an investment project effectiveness criterion ( NPV, IRR, etc. ). Using this method helps to characterize the degree of sustainability of the project to possible changes in the conditions of implementation and to identify the least and most risky factors for the project [6].

The sensitivity analysis is, in fact, a one-factor analysis. The basis for the selection of factors for sensitivity analysis are the results of qualitative methods.

The advantages of the method for analyzing the sensitivity of project performance criteria are - simplicity of calculations, objectivity, theoretical transparency and visibility of the results. In addition to univariate, the disadvantages of the methodology include the subjectivity of the results obtained due to the use of the expert method.

Scenario method.

Scenario analysis represents the development of a sensitivity analysis method for an investment project. Unlike the previous one, it is multifactorial, that is, it is a simultaneous change in the whole group of project factors that are checked for risk. An important advantage of this technique is the fact that the deviations of the parameters are calculated taking into account their interdependencies (correlations) [7]. Scenario analysis allows investors to estimate the profitability for each of the scenarios and the likelihood of events for each of them. It allows to take into account such factors as

• construction time and other works;

• an average increase in the cost of the project is taken into account due to the mistakes of the project organization, the revision of the design decisions during construction and unforeseen expenses;

• delay of payments, irregular supply of raw materials and materials, violations of technology by personnel, etc .;

• an increase in the rate of discount.

Game: Perform tasks and rest cool.3 people play!

Play gameAlgorithm for risk assessment when investing in real estate

As mentioned earlier, any project is analyzed from both qualitative and quantitative points of view. The qualitative aspect involves an economic analysis of the project, and a quantitative aspect involves calculating and estimating the cash receipts for the project, taking into account the influence of various risk factors on its implementation (including accounting for inflation, calculating financial and economic indicators).

Based on the analysis of the methods, a risk assessment algorithm was developed for investment projects related to the reconstruction and development of real estate objects.

The algorithm consists of several stages:

1. Expert risk analysis;

Game: Perform tasks and rest cool.3 people play!

Play game3. Assessment of the sustainability of the investment project based on the development of scenarios, as well as the analysis of the variation of the investment project performance indicators;

4. Analysis of the results, development of measures to optimize the project and minimize project risks. Consider these points in more detail.

1. Expert risk analysis Protection of investments against the influence of negative risks can be ensured if there is a mechanism to eliminate or reduce the causes that generate risks at all stages of the investment, construction and operational processes.

The investment redevelopment process consists of four main stages:

1. Pre-investment (preparatory) phase. At this stage, the development of the concept and a preliminary review of the project, an assessment of the location, as well as a feasibility study of the project and preparation for its implementation.

2. Phase of the object purchase and construction.The main content of this stage is the organization and conduct of tenders, the conclusion of contracts, the execution of major works on the project (construction or development / redevelopment).

3. Phase of operation (sale or rental). At this stage, the project is operated, marketing, managing and managing the results.

4. Phase of completion (sale of the project). In this phase, the final goals of the project are achieved, the results are summarized and conflicts are resolved, the project is closed.

The use of attracted investments is possible only if their return is guaranteed. For this reason, the mechanism for protecting investments from the risks of non-return should be based on the principle of preserving investments at all stages of the investment process, and the amount of investment security should be equal to the value of investments at all stages. For these purposes, a questionnaire was developed, which allows an expert method to analyze the risks that arise during the entire time of the project and assess their impact on the final result. This questionnaire is universal, as in the conditions of various transactions some points or stages may be omitted or added.

Алгоритм экспертного метода состоит из нескольких этапов:

1) Составляется анкета путем выделения простых рисков на каждом из этапов проекта

2) Приглашенными экспертами производится оценка вероятности наступления каждого из событий, после чего находится средняя вероятность реализации риска.

3) Разработчик анкеты проставляет приоритеты в зависимости от оценки важности каждого отдельного события для всего проекта.

4) В соответствии с приоритетами определяются веса и подсчитываются, просты риски путем перемножения весов и среднего значения вероятности. Результат работы экспертов оформляется в виде таблицы.

5) На конечном этапе делаются выводы о наиболее значимых факторах риска, суммарной величине риска на каждой из стадий, а также о рискованности проекта в целом.

Далее после того как риски были проанализированы качественным методом, производится количественный анализ.

2. Расчет основных показателей по проекту и анализ чувствительности

Применение анализа чувствительности инвестиционного проекта заключается в оценке влияния изменения какого-либо одного параметра проекта на показатели эффективности проекта при условии, что прочие параметры остаются неизменными.

Для нахождения ключевых показателей по проекту предполагается использование метода дисконтирования денежных потоков. При этом экономическая обоснованность любого инвестиционного проекта при использовании данной методики в значительной степени зависит от того насколько объективно заложены исходные параметры. В условиях проекта редевелопмента величина денежного потока от реализации проекта зависит, прежде всего, от таких прогнозных параметров, как: коэффициент загрузки, величины инвестиций, необходимого для реализации инвестиционного проекта, себестоимости недвижимости, уровня арендных ставок; уровня инфляции, инвестиционного риски и многих других. Стоит отметить, что ставка дисконтирования является важнейшим параметром, от которого зависит экономическая обоснованность инвестиционного проекта и величина денежных потоков. Выбираются и другие параметры для экономического обоснования инвестиционного проекта.

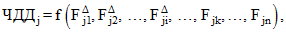

The algorithm for analyzing the sensitivity of an investment project is as follows [1]:

Game: Perform tasks and rest cool.3 people play!

Play game (one)

(one) Game: Perform tasks and rest cool.3 people play!

Play game - constant factors of the j-th scenario;

- constant factors of the j-th scenario;  - variable factors of the j-th scenario.

- variable factors of the j-th scenario.

The conservative scenario is accepted according to the initial version of the calculations, since it is based on the immutability of all project indicators and

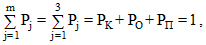

Since uncertainty in any case will lead to the realization of one of the scenarios, and accordingly, the occurrence of all three scenarios simultaneously forms a complete event, the total probability of the occurrence of optimistic, conservative and pessimistic scenarios is one. In addition, each scenario has its own probability of occurrence, which is set by an expert method.

(2)

(2)

Where  - the probability of the j-th scenario,

- the probability of the j-th scenario,  ,

,  - number of scenarios (in the thesis work

- number of scenarios (in the thesis work  );

);

- the likelihood of a conservative, optimistic and pessimistic scenario, respectively.

- the likelihood of a conservative, optimistic and pessimistic scenario, respectively.

To assess the effectiveness of the project in the event of each of the scenarios, it is necessary to calculate the main indicators of the project (NPV, IDDI and the discounted payback period).

Ultimately, a project sustainability assessment is carried out — an analysis is made of the degree of variability of performance indicators when different scenarios of the situation develop.

In order to assess investment risk, indicators of variation are used, which can be interpreted as the degree of variability of the project's effectiveness criteria when different scenarios develop. The higher the variation indicators, the greater the risk level, respectively. In this case, the investment risk shows the degree of the project's effectiveness to various changes in the external environment, which are characterized by their likelihood of occurrence.

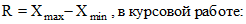

As indicators of variation, through which risk assessment is performed, the range of variation is traditionally used.  , expected value

, expected value  dispersion

dispersion  , standard deviation

, standard deviation  and coefficient of variation

and coefficient of variation  .

.

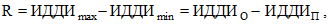

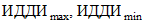

Scope of variation  is determined by the formulas:

is determined by the formulas:

(3)

(3)

(four)

(four)

Where  - maximum and minimum value of the indicator

- maximum and minimum value of the indicator  respectively;

respectively;

- the maximum and minimum value of the profitability index, respectively;

- the maximum and minimum value of the profitability index, respectively;

,

,  investment profitability index under the pessimistic and optimistic scenario.

investment profitability index under the pessimistic and optimistic scenario.

In work as an indicator  It is assumed to use the index of profitability of investments, since it is the change in the indicators of profitability that can be a measure of risk. At the same time, the minimum and maximum values of IDDI correspond to the values of the profitability index under pessimistic and optimistic scenarios.

It is assumed to use the index of profitability of investments, since it is the change in the indicators of profitability that can be a measure of risk. At the same time, the minimum and maximum values of IDDI correspond to the values of the profitability index under pessimistic and optimistic scenarios.

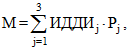

Expected value  characterizes the average expected value of the indicator. In terms of risk assessment, the expectation shows the average expected return of an investment project:

characterizes the average expected value of the indicator. In terms of risk assessment, the expectation shows the average expected return of an investment project:

(five)

(five)

(6)

(6)

Where  - the value of the i-th indicator

- the value of the i-th indicator  ,

,  ;

;

- the probability of occurrence of the i-th indicator

- the probability of occurrence of the i-th indicator  - the probability of the j-th scenario.

- the probability of the j-th scenario.

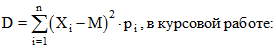

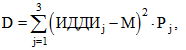

Dispersion  is a measure of the spread and is a weighted average of the squares of deviations of a random variable from its expectation (i.e. deviations of actual results from expected ones) and. The formula for variance is as follows:

is a measure of the spread and is a weighted average of the squares of deviations of a random variable from its expectation (i.e. deviations of actual results from expected ones) and. The formula for variance is as follows:

(7)

(7)

Game: Perform tasks and rest cool.3 people play!

Play game (eight)

(eight) Game: Perform tasks and rest cool.3 people play!

Play game - the value of the i-th indicator

- the value of the i-th indicator  ,

,  ;

;  ,

,  probability of occurrence of the j-th and i-th indicator.

probability of occurrence of the j-th and i-th indicator.

Standard deviation  It is also a measure of absolute variability and has the same units of measurement as the baseline. Standard deviation

It is also a measure of absolute variability and has the same units of measurement as the baseline. Standard deviation  calculated by the formula:

calculated by the formula:

(9)

(9)

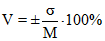

Using the coefficient of variation, we conclude on the variability of the indicators:

(ten)

(ten)

The coefficient of variation is a dimensionless quantity and is most often measured in percentages - from 0 to 100%. The greater the coefficient of variation, the greater the variability.

The coefficient of variation is the final measure of the variability of project performance indicators when environmental factors change.

4. Analysis of the results obtained, the development of measures to optimize the project and minimize project risks

After conducting a risk analysis, it is necessary to develop measures to optimize the project and minimize project risks.

These techniques can be divided into several groups:

risk localization;

risk aversion;

risk compensation;

risk diversification. Localization of risk. This method is used in those rare cases when it is possible to clearly identify risks, as well as the sources of their occurrence. For this, the economically most dangerous stages of the project are separated into separate structural units, after which they can be made more controlled, which will reduce the level of risk. To carry out risky projects in the business environment, localization of risks is often created by special structural units (with a separate balance sheet) [4].

Risk avoidance. Basis the application of this technique is to work only with trusted and reliable partners, which includes, for example, the rejection of unreliable management companies or the limitation of their portfolio of possible tenants.

Risk compensation. An example illustrating the specifics of risk compensation is strategic planning of activities. Strategic planning allows you to identify the main sources of risk and thereby removes most of the uncertainty, which will allow the entrepreneur to predict the appearance of bottlenecks in the implementation of projects. As a result, compensating measures and a plan for the use of reserves are developed. Currently, this technique is especially important due to the relative incompleteness of information and analytical support for the real estate market [3].

Risk diversification. The basis for risk diversification is the preference for the implementation of several relatively small investment projects than the implementation of one large investment project, which requires the use of all resources, without leaving room for maneuver [5].

As a result, a risk assessment algorithm was proposed for analyzing the risk of investing in commercial real estate, including both qualitative and quantitative risk assessment approaches. The advantage of this method of assessment is that, on the one hand, it involves taking into account all risk factors at each of the project stages (using the expert method), on the other hand, it allows you to identify key parameters affecting the project's effectiveness (sensitivity analysis),

as well as take into account the most unlikely, but highly risky crisis situations that may occur in the unstable Russian real estate market, generating the expected cash flows for the project, taking into account various scenarios.

Что бы оставить комментарий войдите

Комментарии (0)